A Company Uses a Periodic Inventory System. On August 1

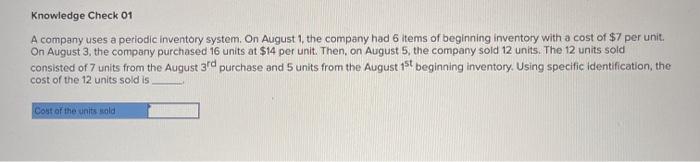

On August 1 the company had 6 items of beginning inventory with a cost of 7 per unit. On August 1 the company had 6 items of beginning inventory with a cost of 7 per unit.

Solved Entation Videos Saved Help Save Required Information Chegg Com

On August 3 the company purchased 16 units at 14 per unit.

. If a company uses a periodic inventory system. The 12 units sold consisted of 7 units from the August 3rd purchase and 5 units from the. A company uses a periodic inventory system on august 1 the company A company uses a periodic inventory system on august 1 the company had 6 items of beginning inventory with a cost of 7 per unit on August 3 the company purchased 16 units at 14 per unit then on August 5 the company sold 12 units the 12 units sold consisted of 7 units from the August 3rd.

A company uses a periodic inventory system. Then on August 5 the company sold 12 units. On August 1 the company had 6 Items of beginning Inventory with a cost of 7 per unit.

A company uses a periodic inventory system on august 1 the company a company uses a periodic inventory system on august 1 the company had 6 items of beginning. On August 3 the company purchased 16 units at 14 per unit. On August 1 the company had 6 items of beginning inventory with a cost of 7 per unit using specific identification the cost of the 12 units sold is 133.

A company uses a periodic inventory system on august 1 A company uses a periodic inventory system on august 1 the company had 6 items of beginning inventory with a cost of 7 per unit on August 3 the company purchased 16 units at 14 per unit then on August 5 the company sold 12 units the 12 units sold consisted of 7 units from the August 3rd purchase and 5 units from the. Purchase March 21 6030 5 Purchase August 1 4150 3 Inventory December 31 current year. The 12 units solo consisted of 7 units from the August 3rd purchase and 5 units from the August 1st.

On August 1 the company had 6 items of beginning inventory with a cost of 7 per unit. On August 1 the company had 6 items of beginning inventory with a cost of 7 per unit. The 12 units sold consisted of 7 units from the August 3rd purchase and 5 units from the August 1st beginning inventory.

Units Unit Cost Inventory December 31 prior year 1960 6 For the current year. On August 3 the company purchased 16 units at 14. On August 3 the company purchased 16 units at 14 per unit.

On August 3 the company purchased 16 units at 14 per unit. On August 3 the company purchased 16 units at 14 per unit. On August 3 the company purchased 16 units at 14 per unit.

Then on August 5 the company sold 12 units. Using FIFO the cost of 12 units sold is. Then on August 5 the company sold 12.

On August 3 the company purchased 16 units at 14 per unit. Then on August 5 the company sold 12 units. A company uses a periodic inventory system.

On August 1 the company had 6 items of beginning inventory with a cost of 7 per unit. Knowledge Check 01 A company uses a periodic inventory system. Then on August 5 the company sold 12 units.

On August 3 the company purchased 16 units at 14 per unit. Hamilton Company uses a periodic inventory system. Cost of units soldUnits from the August 3rdPurchased from August 3rdUnits for August 1Purchased from August 3rd Where.

Business 14102021 1400 kaciebrin211. The company uses the periodic inventory system. A company uses a periodic inventory system.

On August 1 the company had 6 items of beginning inventory with a cost of 7 per unit. On August 1 the company had 6 items of beginning inventory with a cost of 7 per unit. On August 1 the company had 6 items of beginning inventory with a cost of 7 per unit On August 3 the company purchased 16 units at 14 per unit.

A company uses a periodic inventory system. Then on August 5 the company sold 12 units. At the end of the annual accounting period December 31 of the current year the accounting records provided the following information for product 1.

Then on August 5 the company sold 12 units. On August 1 the company had 6 items of beginning inventory with a cost of 7 per unit. Problem 8 - 1 Penn Company uses a periodic inventory system.

Then on August 5 the company sold 12 units. Problem 13-1 Described below are certain transactions of Edwardson Corporation. On August 3 the company purchased 16 units at 14 per unit.

A company uses a periodic inventory system. On February 2 the corporation purchased goods from Martin Company for 73200 subject to cash discount terms of 210 n30. Then on August 5 the company sold 12 units.

A company uses a periodic inventory system. At the end of the annual accounting. On August 1 the company had 6 items of beginning inventory with a cost of 57 per unit.

A company uses a periodic inventory system on august 1 the company a company uses a periodic inventory system on august 1 the company had 6 items of beginning inventory with a cost of 7 per unit on august 3 the company purchased 16 units at 14 per unit then on august 5 the company sold 12 units the 12 units sold consisted of 7 units from the august 3rd. View Homework Help - Class 8 Inventory Practice Solutions from ACCOUNTING 800 at Suffolk University. A company uses a periodic inventory system.

On august 5 the company sold 12 units the 12 units sold consisted of 7 units from the august 3rd purchase and 5 units from the august 1st beginning inventory using specific identification the. Then on August 5 the company sold 12 units. Using specific identification the cost of the 12 units sold is Cost of the units sold Knowledge Check 01 A company uses a periodic inventory system.

A company uses a periodic inventory system. Knowledge Check 01 A company uses a periodic Inventory system. Purchases and accounts payable are recorded by the corporation at net amounts after cash discounts.

Solved Knowledge Check 01 A Company Uses A Periodic Chegg Com

Solved Knowledge Check 01 A Company Uses A Periodic Chegg Com

Solved Knowledge Check 01 A Company Uses A Periodic Chegg Com

0 Response to "A Company Uses a Periodic Inventory System. On August 1"

Post a Comment